Services

We Offer

What We Provide

We use a modern, cloud-based accounting system designed just for your business. You don’t need to know much about technology; we’ll set everything up and get you going.

Bookkeeping Services

The Pinnacle to any successful business is the management of its finances. Effective bookkeeping guides strategy and clears a way for growth – it is the way through the storm of uncertainty. Let us manage the books so you can have more time to focus on rest!

Financial Statement Preparation

Preparation of your financial statements is one of the last steps in the accounting cycle. We prepare financial statements including the income statements, balance sheet, and cash flow statement, to summarize the financial performance and position of an entity over a specific period. These statements are crucial for internal management, as well as for external stakeholders such as investors, creditors, and regulatory authorities

Payroll Services

Payroll Accounting involves calculating and Processing employee wages, salaries, taxes, and benefits. This includes tasks such as timekeeping, payroll deductions, tax withholding, and issuing paychecks or directdeposits.

Tax Preparation and Planning

Tax Preparation and Planning We help individuals and businesses comply with tax laws and regulations by preparing and filing tax returns accurately and timely. We also provide tax planning services to minimize tax liabilities, maximize deductions, and optimize tax strategies.

Financial Analysis

We analyze financial data and performance metrics to assess the financial health and profitability of an entity. This may involve ratio analysis, trend analysis, variance analysis, and other techniques to interpret financial information and identify areas for improvement

Forensic Accounting

We investigate financial irregularities, fraud, and disputes by analyzing financial records, transactions, and evidence. They may be engaged in litigations support, financial investigations, or dispute resolution proceedings.

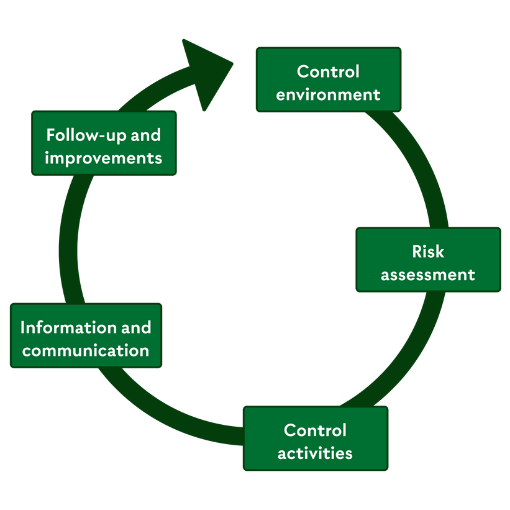

Internal Control and Compliance

We help organizations establish and maintain effective internal controls to prevent fraud, errors, and financial misstatements. We also ensure compliance with regulatory requirements, industry standards, and accounting principles.

Specialized Accounting Services

We offer specialized services tailored to specific industries or niches, such as healthcare accounting, non-profit accounting, government accounting, real estate accounting.

Management Consulting

We provide strategic advice and consulting services to help business improve financial management, operational efficiency, and profitability. This may include budgeting, cost analysis, cash flow management, forecasting, business planning.

Financial Planning and Analysis (AP&A)

We support businesses in developing financial plans, forecasting future performance, analyzing financial data, and making informed strategic decisions. They play a crucial role in budgeting, financial reporting, and performance measurement.

Tax Advisory

We provide guidance on minimizing tax liabilities while ensuring compliance with applicable laws and regulations. They help individuals and businesses navigate complex tax issues, optimize tax strategies, and identify tax saving opportunities.

Manage Accounts Payable

We modify the payment systems of the business by managing financial transactions, coming up with expenditure solutions, excluding duplication, and managing financial documents.

Manage Accounts Receivable

We help in boosting the collection rate of a company, reduce the period of payments, and ensure fast processing of invoices.

Don't Hesitate To Contact Us

- Denmark

- info@eesybooks.dk